[ad_1]

The US Federal Reserve held its policy rate steady last week, as expected.

Today’s post will provide highlights from the Fed’s latest policy statement and accompanying press conference, and outline the implications for Canadian fixed and variable mortgage rates.

Let’s start with a quick recap of the current US economic backdrop.

US GDP grew at a stronger-than-expected pace throughout 2023, buoyed by the US federal government’s high levels of deficit spending and by the rapid drawdown of pandemic savings by many US consumers. That momentum also kept US inflation oscillating within the low 3% range, well above the Fed’s 2% target.

Then the US economy started to slow at the start of this year.

US GDP growth fell from 3.4% (annualized) in Q4 2023 to 1.3% in Q1 2024, but despite that, US inflation continued to hover in the low 3% range. Bond market investors began to price in Fed rate cuts in response to slowing growth, but the Fed’s voting members pushed back against that notion and maintained their focus on cooling inflation.

With that context now established, here are the highlights from the Fed’s latest communications:

- At its previous meeting on May 1, the Fed assessed that there had been “a lack of further progress on inflation”. But this time it observed “modest further progress toward the Committee’s 2 percent inflation objective.”

- The Fed is now forecasting only one rate cut in 2024, down from three projected cuts at its March meeting. The other two cuts were pushed into 2025. The Fed maintained its projection that its policy rate will fall to 3.1% by the end of 2026.

- The Fed now believes that “supply and demand have come into better balance” in the labour market, and “conditions in the labor market have returned to about where they stood on the eve of the pandemic, relatively tight but not overheated”.

- US Fed Chair Powell poured water on hopes of a near-term rate cut when he said that they “will need to see more good data to bolster our confidence that inflation is moving sustainably toward 2 percent.”

- Despite Powell’s comments, the US bond-market is still pricing in two Fed cuts this year.

In summary, the Fed is maintaining a wait-and-see approach for now. It believes that it has the luxury to do this because the US economy still has decent momentum (although less than last year).

Implications for Canadian Variable Mortgage Rates

The Bank of Canada (BoC) and the US Fed are now on different monetary-policy trajectories.

The BoC enacted its first cut earlier this month and its policy rate now stands at 4.75%, whereas the Fed funds rate now fluctuates in a range between 5.25% and 5.50%.

That gap may well widen in the months ahead. The BoC is expected to cut twice more this year, with the next cut coming as early as its next meeting in July. The Fed’s first cut isn’t expected until November.

There is logical concern that a divergence in monetary-policy rates will substantially weaken the Loonie against the Greenback, thereby stoking inflation pressures in Canada by raising the prices of everything we import from US markets.

But the BoC has indicated that it is prepared to live with that development for the time being. In a recent speech to the House of Commons finance committee, Governor Macklem conceded that “there is a limit” to how far the BoC’s policy rate can diverge from the Fed’s policy rate, but he also reassured the parliamentarians that “we’re not close to that limit” at the present time.

It should also be noted that in the mid-1990s, the BoC’s policy rate fell 2% below the Fed funds rate, and at that time, the Loonie traded at $1.40 against the Greenback. Today the Loonie trades at $1.38 even though our policy rates are only 0.50% apart. That leads me to conclude that the Loonie is already priced for the gap between Canadian and US policy rates to widen further.

Simply put, I don’t think the Fed decision to stand pat last week will materially impact the BoC’s near-term rate-cut plans.

Implications for Canadian Fixed Mortgage Rates

Our fixed mortgage rates are priced on Government of Canada (GoC) bond yields, which typically follow in the wake of their US equivalents. That tight correlation means that GoC bond yields can get pulled higher by strong US economic data, even if weak Canadian data are released at the same time.

This also means that our fixed mortgage rates may be pulled higher than they would be if they were solely reflecting the state of our domestic economy. Anyone who has been watching GoC bond yields will be able to recall many examples of this playing out, in the short term, on a week-to-week basis.

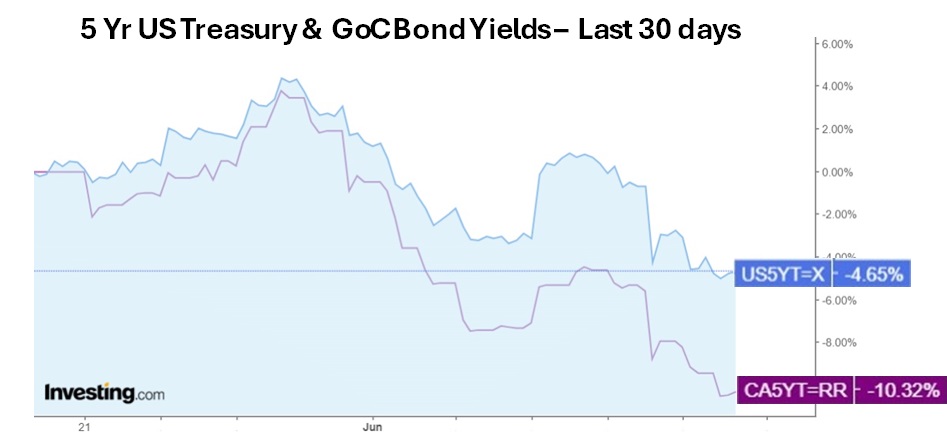

It is interesting to note that lately, while GoC bond yields have continued to follow their US Treasury equivalents directionally, the relative gap between the two yields has widened substantially.

The chart below compares the paths of the 5-yr GoC and US Treasury yields over the last thirty days). We should still expect GoC bond yields to be subject to the directional pull of their US Treasury equivalents going forward. But the widening gap between their yields over the past 30 days provides reassurance that the correlation is now less tight

We should still expect GoC bond yields to be subject to the directional pull of their US Treasury equivalents going forward. But the widening gap between their yields over the past 30 days provides reassurance that the correlation is now less tight

Put another way, if our economic momentum continues to weaken relative to the US, GOC bond yields and our fixed mortgage rates may respond more directly to our domestic weakness than analysts feared they would (including this blogger). The Bottom Line: GoC bond yields followed their US equivalents lower last week. Gross lending spreads were narrower than normal prior to the recent drop in yields, so rate cuts have been slow in coming. At some point the dam will break and fixed rates will fall.

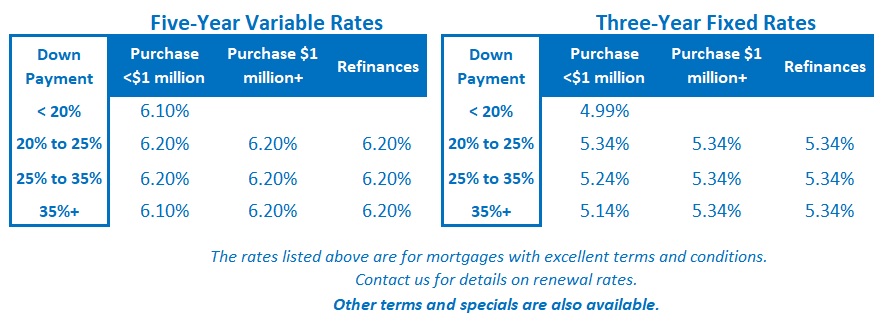

The Bottom Line: GoC bond yields followed their US equivalents lower last week. Gross lending spreads were narrower than normal prior to the recent drop in yields, so rate cuts have been slow in coming. At some point the dam will break and fixed rates will fall.

Variable-rate discounts were unchanged last week. Variable-rate borrowers will now have seen their rates drop by 0.25% in response to the BoC’s recent cut. I expect that more rate relief will be on the way as early as the Bank’s next meeting on July 24.

[ad_2]

Source link

.png)