[ad_1]

The Bank of Canada (BoC) reduced its policy rate from 5.00% to 4.75% last week, marking its first cut since it slashed its policy rate by 1.50% in March 2020 during the early stages of the pandemic.

Variable-rate mortgages and line-of-credit rates were reduced by the same 0.25% shortly thereafter, saving borrowers about $25/month for every $100,000 borrowed at a 25-year amortization. (You can calculate your exact saving with Mortgage Payment Calculator.)

Fixed mortgage rates did not change. They are priced on Government of Canada (GoC) bond yields, which had already fallen from their peaks in anticipation of the BoC’s first cut.

Here are the key highlights from the BoC’s latest policy statement, its press conference opening statement, and from the Q & A session that followed:

- The BoC believes that inflation is now on a clear path back to 2%.

The Bank observed that “indicators of underlying inflation increasingly point to a sustained easing” of inflation pressures. It cited four key indicators to support this assessment:

- CPI inflation has eased from 3.4% in December to 2.7% in April.

- Preferred measures of core inflation have come down from about 3.5% last December to about 2.75% in April.

- The 3-month rates of core inflation slowed from about 3.5% in December to under 2% in March and April.

- The proportion of CPI components increasing faster than 3% is now close to its historical average, suggesting price increases are no longer unusually broad-based.

The BoC also believes that our economy’s excess capacity will ensure that it has room for non-inflationary growth ahead.

While it noted that upside risks to inflation remain, the Bank sounded surprisingly confident in its assessment that inflation pressures would continue to ease.

- More rate cuts are likely on the way.

There is no guarantee that the BoC will cut at its next meeting on July 24. The Bank reiterated that it will be “taking our interest rate decisions one step at a time” and said that “it is reasonable to expect more cuts if inflation continues to ease”.

But if the Bank believes that we’ll see a sustained easing in inflation pressures and that our economy has ample room for non-inflationary growth, it needs to keep the rate cuts coming.

Our economy is now showing increasing signs of financial strains, which include higher consumer debt utilization and default rates alongside surging business bankruptcies. We will also have increasing mortgage-payment shocks at renewal. In the GTA, residential real-estate listings just hit a new ten-year high according to real-estate agent John Pasalis, who recently noted that there are now a record number of condos for sale as “investors are rushing for the exits”.

- It is reasonable to expect total BoC rate cuts of between 1.5% to 2% over this rate-cut cycle.

Thus far, BoC Governor Macklem has warned that rate cuts will probably be gradual, and the policy rate may not drop to its pre-pandemic levels. I still expect a total reduction of between 1.5% and 2% before this rate-cut cycle is complete.

For starters, one of the Bank’s chief concerns is that rate cuts will trigger a surge in real-estate demand, so jawboning down expectations is a simple and cost-free way to help keep speculators in check. But rhetoric aside, if inflation pressures are no longer tying the Bank’s hands, it will be compelled to react to weakening economic conditions rather than to dictate to them.

As noted in the chart I published in last week’s post, the BoC has cut by an average total of 2.35% over its last five rate-cut cycles – and we now have record household and government debt being hit by the sharpest series of rate hikes in modern history.

It is tempting to assume that at this point the brunt of the impacts from the Bank’s rate hikes are now behind us, because most of the hikes occurred more than eighteen months ago. But one-off factors such as elevated household savings (from the pandemic), record immigration, and profligate government spending have increased the lag time between when the rate hikes were enacted and when they will be fully felt.

If we experience a sharper-than-expected economic slowdown ahead, which I expect we will, the BoC’s policy rate will need to be lowered to a level that will spur growth, not restrict it.

The Bank now estimates that the neutral level for its policy rate is in a range between 2.5% and 3.0%. (The neutral rate is loosely defined as the policy-rate level that neither stimulates economic growth nor restricts it.)

While it is quick to point out that its neutral rate estimate is a theoretical construct and a moving target, that number is still one of the best reference points that we have. A neutral-rate level of about 3% is consistent with other independent analyses that try to answer the same question.

If we get a recession, and if the BoC’s neutral policy-rate level is deemed to be 3%, it won’t be stimulating growth until it drops its policy rate below that level.

- Factors that could upset the apple cart.

The main challenge in predicting interest rates is the shear multiplicity of factors that influence their direction. For example, here are the three key upside risks to inflation that the BoC is most closely watching:

- Global tensions – A total wildcard. Tensions are rising across the globe, from Ukraine to Israel, and from Taiwan to Guyana. Each hot spot has the potential to impact global prices.

- House prices rising faster than expected – This risk suddenly appears less imposing in Canada’s largest housing market. The GTA saw a 47% spike in new listings in April (year-over-year) while sales were down 5% over the same period. Other regions, such as Kitchener/Waterloo, are experiencing larger declines. Deteriorating market conditions should further decrease the propensity for speculative real-estate investment.

- Wage growth remains high relative to productivity – Wage growth re-accelerated in May, rising by 5.1% compared to 4.7% in April. That said, the supply of labour has expanded faster than our economy’s demand for it thus far in 2024. That should dampen wage pressures. And productivity rates weren’t helped by the federal government’s recently announced capital-gains tax hike. This will discourage business investment at the very time that the BoC says we desperately need more of it.

While the above risks certainly have the potential to delay the BoC’s rate-cut plans, I think the balance of probability still points to reduced overall inflation pressure accompanied by weak economic growth. If that unfolds, the Bank will keep cutting.

- The BoC is not overly concerned with what the US Federal Reserve is doing right now.

Much has been made of the fact that the BoC has started to reduce its policy rate ahead of the US Federal Reserve.

The concern is that the Loonie will tank against the Greenback, which will raise the cost of everything we import from the US. If that happens, it could substantially increase domestic inflation pressures.

At the BoC’s press conference, Governor Macklem reiterated his confidence that the Bank is “not close” to the limits of how far it can deviate from the US Fed funds rate. Economist David Rosenberg also recently noted that the BoC’s policy rate was 2.00% below the Fed funds rate in the mid-90s. (For reference, the current gap between our policy rates is 0.75%.)

With the first BoC rate cut now official, it is natural to speculate on how low the Bank will ultimately go. While I expect we’ll see several more cuts in the months ahead, for now, let’s accept BoC Governor Macklem’s response when reporters peppered him with questions about what comes next.

After a long sigh, Macklem responded, “let’s just enjoy the moment”.

If you’ve been sweating it out with a variable rate mortgage, I highly recommend following that advice.

Mortgage Selection Advice for Now

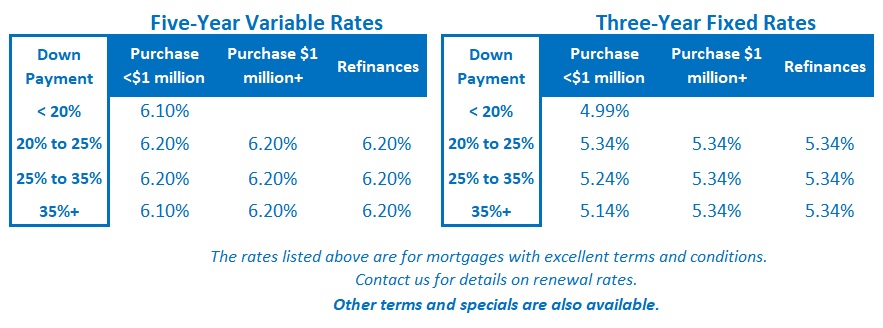

If you’re willing to start your term with a higher rate and to assume the inherent risk that the BoC’s policy rate may not fall as quickly, or by as much as expected, I think five-year variable rates are now most likely to generate the lowest borrowing cost over the entire term of the mortgage.

There is no way to know for sure where rates are headed. Since our current interest-rate cycle has peaked, the odds favour variable-rate mortgages.

Alternatively, if you’re a more conservative borrower, I think three-year terms are still the best choice among today’s fixed-rate options. The premiums required for one- and two-year fixed rates remain substantial. And while five-year fixed-rate terms come with today’s lowest rates, I still worry that five years is too long to be locking in when rates are near their highest levels in more than three decades. The Bottom Line: GoC bond yields dropped a little last week, but not by as much as many mortgage borrowers hoped/expected.

The Bottom Line: GoC bond yields dropped a little last week, but not by as much as many mortgage borrowers hoped/expected.

This was a result of two main factors: 1) GoC bond yields had already priced in BoC rate cuts, and 2) GoC bond yields remain anchored by their US treasury equivalents.

For now, our fixed mortgage rates remain range bound.

Five-year variable rate discounts were unchanged last week. The lenders all dropped their prime rates by 0.25% to match the BoC’s move. For the reasons outlined above, I believe that a sharper-than-expected economic slowdown will compel the Bank to continue lowering its policy rate in the near term.

[ad_2]

Source link