Last week’s economic data releases on both sides of the 49th parallel provided further confirmation that the US and Canadian economies remain on divergent economic trajectories.

In Canada we received a softer-than-expected retail sales report. It showed that our weakness in consumer spending is broadening out. That bolstered the beliefs that the Bank of Canada’s (BoC)’s first rate cut will happen at its next meeting on June 5 and that there will be a total of three 0.25% cuts in 2024.

When the BoC starts to reduce its policy rate, variable mortgage rates will decrease by the same amount immediately thereafter. That will be good news for Canadian variable-rate mortgage borrowers.

Borrowers who are more interested in a fixed mortgage rate will probably see their available options becoming more expensive over the near term.

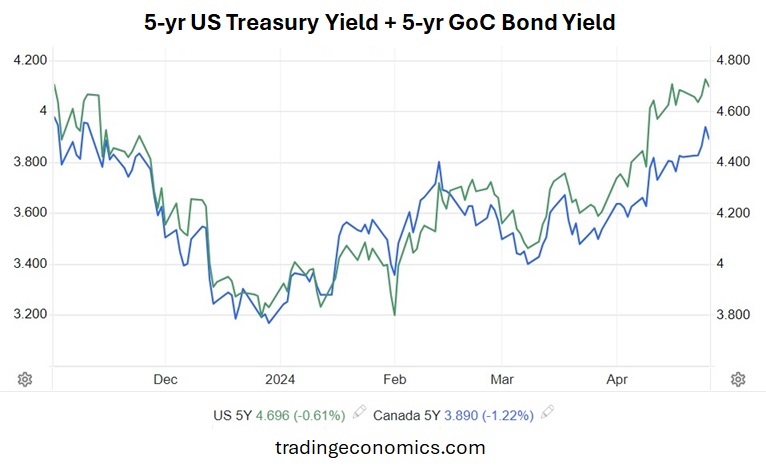

Our fixed mortgage rates are priced on Government of Canada (GoC) bond yields, which move in near lockstep with their US Treasury equivalents. US Treasury yields have been on a steady march higher of late. A string of stronger-than-expected US economic data imply that the US Federal Reserve will have to keep its policy rate higher for longer to sufficiently cool US inflation.

On that note, US market watchers learned last week that an important US inflation measure, the core personal consumption expenditures (PCE) index, came in at 2.8% in March, higher than expected. The latest US GDP data, also released last week, came in below the consensus forecast, but the weakness was in net exports and inventory investment. US domestic demand, which is the main driver of US economic momentum, stayed strong.

The US economy’s resilience has bond-market investors questioning whether the US Federal Reserve will cut at all in 2024. The US futures market is now pricing in only one 0.25% rate cut this year, after pricing in six 0.25% cuts back in January.

At some point, however, US economic momentum should slow.

The US federal government’s deficit is still providing a strong tailwind, but it is unusually large for this point in the US economic cycle and is almost certainly unsustainable. At the same time, US consumer spending has been buoyed less by rising income and more by reductions in savings and increased credit-utilization. Those trends are also unsustainable.

The question of when the US economy will start to slow is much harder to determine. It will probably keep chugging along until the US election in November, and there is plenty of motivation among US policy makers to ensure that happens. If their efforts are successful, US yields (and likely their GoC equivalents) won’t be coming down until most of the borrowers who are in the market for a mortgage today have long since signed on the dotted line.

The chart below shows that the yields on 5-year US Treasuries and GoC bonds have already increased by more than 1% in 2024. Interestingly, and somewhat ominously, the best five-year fixed mortgage rates are lower today than they were back in January.

Interestingly, and somewhat ominously, the best five-year fixed mortgage rates are lower today than they were back in January.

That is in part because gross lending spreads were wider than normal to start the year. But they are now narrower than normal, and that means fixed rates will probably rise above their current range soon.

Mortgage Selection Advice for Today

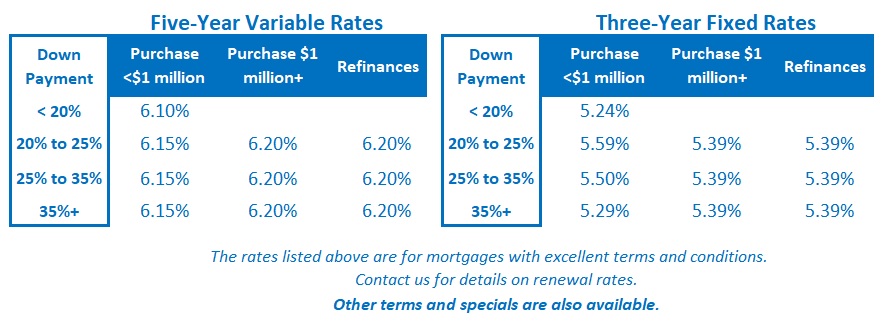

If you’re willing to start your term with a higher rate and assume higher potential risk, I think variable rates are well worth considering. We can never be certain how things will play out, and there is still a risk that the BoC’s first rate cut may take longer than expected to materialize. But I think the Bank will cut its policy rate substantially during the next phase of its policy-rate cycle. When that happens, variable rate borrowers will benefit significantly.

Alternatively, if you’re a more conservative borrower, concerned that stickier-than-expected inflation will continue to keep rates elevated, I think terms in the three-year range are still the best choice among today’s available fixed-rate options. The premiums required for one- and two-year fixed rates remain substantial. While five-year fixed-rate terms come with today’s lowest rates, I still worry that five years is too long to be locking in when rates are still near their highest levels in more than three decades.

In addition to selecting the right mortgage type and term, borrowers are also well advised to pay close attention to the terms and conditions in their mortgage contract. These details can have a significant impact on the overall cost of the loan.

The Borrower Beware section of my blog provides plenty of detail on that front. If you want to start with a post that provides a detailed summary of the t’s and c’s to watch out for, What’s in the Fine Print is a great place to start. The Bottom Line: GoC bond yields were range bound last week, but gross lending spreads are the narrowest they have been in some time. That means fixed mortgage rates may well increase over the near term.

The Bottom Line: GoC bond yields were range bound last week, but gross lending spreads are the narrowest they have been in some time. That means fixed mortgage rates may well increase over the near term.

Variable-rate discounts have widened out a little of late.

Canadian economic data continue to indicate softening economic conditions. We’ll receive one more inflation report before the BoC’s next meeting. If it confirms that prices have continued to cool, the Bank’s first cut may materialize on June 5, but probably no later than its following meeting on July 24.